Utility, Telephone, and Tax Invoice Management for Homebuilders, Construction and Land Development: For Every Site, Stage and Scale

Utility and Tax Invoice management cycle for Homebuilders, Land management and construction - Video Coming Soon

Managing utility and property tax bills in the homebuilding, construction, and land development industries is anything but straightforward. Invoices arrive with limited context, lots or job sites are in different sales and construction stages, and accounting teams are left to decipher the unknown. Non-Lot Jobs, such as Model Homes and Construction Trailers, also create a challenge, yet are unique by address and account number. MASYC’s utility, telephone, and tax bill workbench solves this complexity by integrating lot-level data, automating voucher creation, and improving financial reporting across the board.

Built for Accounts Payable teams in homebuilding, construction and land development operations, this solution ensures every bill is coded correctly the first time with no guesswork, time-consuming corrections, or missed accruals.

Bring Clarity to Utility and Tax Bills for Lot Jobs

In most homebuilder organizations, utility, telephone, and property tax invoices come with vague references – no lot stage, no close date, and often lack clear references and no indication of whether the job is active. Accounts Payable teams frequently have little choice but to code these invoices to a generic account, which can lead to inaccuracies in both reporting and accruals.

Our solution retrieves real-time homebuilder lot information, including:

lot type

sales status,

construction status

closing date

This allows your accounts payable team to accurately and efficiently book tax and utility expenses. Our approach eliminates the blind spots that make traditional invoice coding a liability.

The MASYC Utility and Tax Workbench allows you to:

View lot sales and construction status directly within the voucher interface

Workbench brings in information from the lot and sales tables.

Automatically apply correct coding based on job stage and utility type

Set up default coding to bring into the workbench.

Separate utility bills by type (cable, gas, phone) for precise coding

Track costs separately based on the type of utility.

Prevent payments on closed lots or disconnected services

Stop overpaying for bills that are no longer your responsibility.

Track bills for telephone records by unique number and order number

Efficient tracking of active and disconnected telephone services

Mass upload from a spreadsheet to create utility records

Streamline adding a large amount of utility records

MASYC’s Utility and Tax Invoice Solution is specifically designed for JD Edwards construction customers. Users familiar with the complexities of paying utility bills on jobs can appreciate the simplicity with which our workbench was designed.

End The Guesswork: Define Default Coding by Lot Stage

One of the biggest challenges the Accounts Payable team faces is not knowing what stage a lot is in or how that should affect the utility or tax bill GL coding. Our solution allows your team to define default coding accounts for each job stage, including:

Completed Lots

Uncompleted Lots

Completed Model Lots

Uncompleted Model Lots

Non-Lot Jobs (trailers, sales office, division overhead)

These configurations are directly tied to your EnterpriseOne system setup and utility types, allowing you to manage different sets of accounts for cable, gas, electric, water, and more. The result is accurate GL coding on every voucher with no room for error.

Configuration Made Simple:

Use processing options to define utility-specific GL accounts

Apply coding rules based on both lot status and utility type

Maintain consistency across Accounts Payable entries and financial reports

Adjust or override at the voucher level with full audit tracking

Adapt quickly to operational or regulatory changes

Automate Property Tax Processing with the Tax Workbench

Just like utilities, property taxes present their own unique set of challenges for AP and GL teams. Property tax bills must be processed in accordance with state or provincial regulations that require either accrual-based or amortized expense recognition.

Our Tax Billing Workbench handles these requirements by automatically pulling lot-level data to inform accurate coding, date handling, and payment logic. This system streamlines data entry and ensures compliance with complex regional tax requirements. Our solution includes a separate workbench for handling Parcel Tax Billing since units of land are treated differently than property taxes for valuation purposes.

A dedicated mass maintenance screen allows you to load tax accrual accounts from Excel by year, by community, or even multiple times per year if needed for semi-annual or quarterly payment structures.

Property Tax Workbench Features:

Automatically apply GL coding and payment logic based on jurisdiction

Load accrual account records in bulk from Excel

Support annual, semi-annual, and multi-period payment cycles

Automatically create amortization or accrual entries by lot

Generate accurate tax vouchers with visibility into close/construction dates

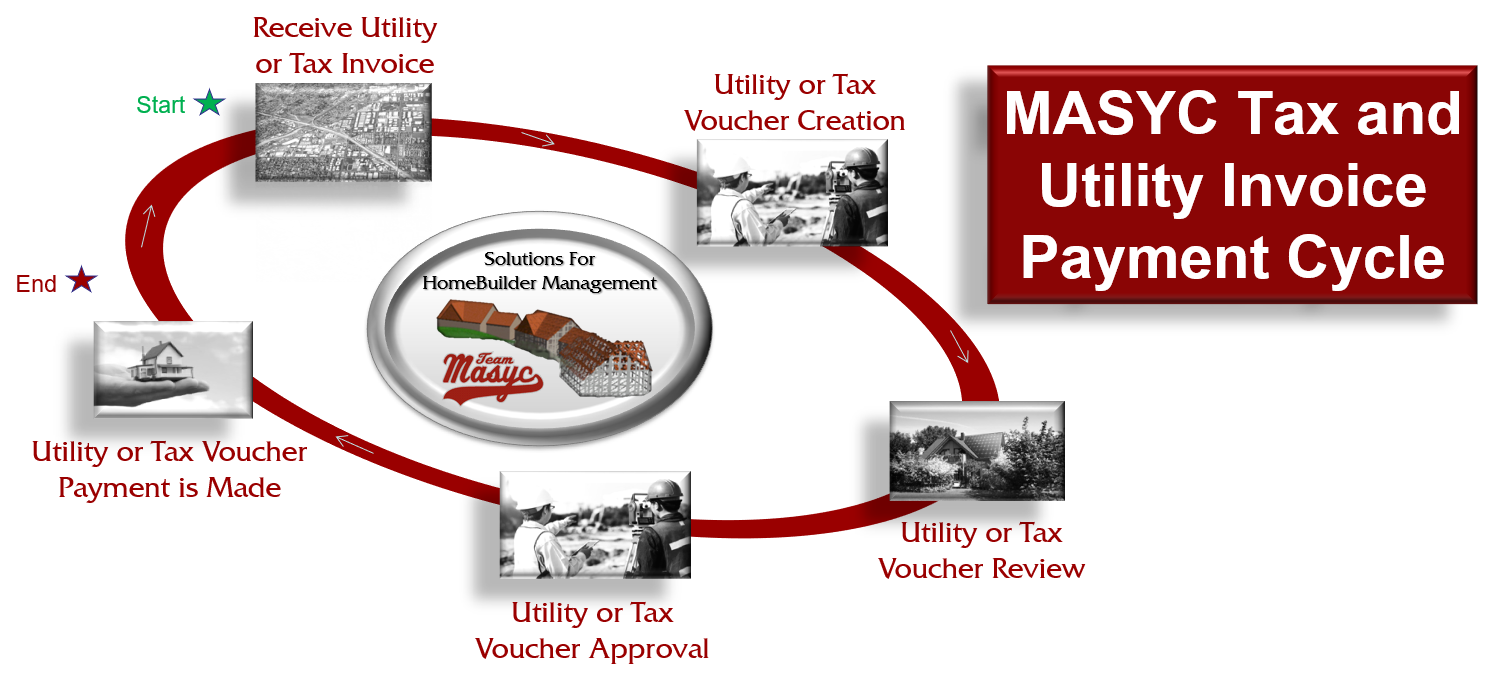

A Smarter Workflow for Utility and Property Tax Invoice Management

Our utility workbench streamlines utility and property tax invoice processing, transforming a manual task into an efficient workflow. From the moment a bill is received, the system takes over, validating lot status, applying the appropriate coding, and generating vouchers ready for review.

The five-stage process ensures visibility and control from start to finish:

Utility or Tax Invoice Received

Voucher Creation (Automated)

Option to include Tax and Utility records in MASYC’s custom AP Approval Process before voucher creation.

Voucher Review

Voucher Approval

Voucher Payment

This standardized cycle reduces human error and provides an audit-friendly trail for every bill processed.

Managing Utilities and Taxes for Non-Lot Jobs with Confidence

Not all utility or tax bills are tied to individual lots. Construction trailers, sales offices, and community-wide overhead accounts must also be tracked.

Our solution brings the same intelligence and automation to non-lot jobs, allowing teams to define default GL codes for each entity and utility type. This helps avoid incorrectly booking a community overhead electric bill to a model home and ensures that all expenses are reported accurately.

Benefits for Non-Lot Utility and Property Tax Management

Predefined GL accounts for non-lot jobs and overhead

Eliminate miscoding of sales/marketing and trailer-related invoices

Accurate cost tracking and reporting across departments

Reduce reclassification work during monthly close

Avoid budget misalignment and untracked spend

Simplified tracking of Telephone Billing

Our Telephone Billing workbench provides a crucial data tracking tool for entering master records that can be linked to multiple telephone numbers. Our solution combines efficient tracking and research of existing and disconnected telephone services via installation and disconnect dates, thereby streamlining the invoice entry process. The workbench enables monitoring to prevent the generation or processing of invalid invoices.

Benefits of Telephone Bill Management

Single Vendor Account/Order Number record with individual numbers

Predefined GL accounts by phone type, such as main or cell

Accurate cost tracking and reporting by department

Reporting for efficient review of bills to identify over- or underpayment issues

Financial Control and Advanced Reporting

Our Utility and Tax Billing platform features powerful reporting tools that provide finance teams with the insight they need to maintain control and compliance.

From audit reports that trace every invoice to its payment, to tax control sheets that track accruals by lot or region, you’ll always have visibility into what’s been paid, what’s pending, and whether anything has slipped through the cracks.

You can also generate historical reports for both utilities and property taxes to support planning, forecasting, and year-end audits.

Key Reporting Capabilities

Utility and tax spend tracking by lot, job, or division

Accrual vs actual payment reconciliation

Historical reporting for utilities and taxes

Duplicate or missing payment detection

Tax control sheets and payment status summaries

Why Homebuilders Choose The MASYC Utility and Tax Solution

Homebuilding is fast-paced and detail-oriented. Inaccuracies in utility or property tax billing can ripple through your financials, affect margins, and cost hours in rework. Our Utility and Tax Billing AP Workbench was built specifically for homebuilders, bringing automation, real-time data, and accuracy to a process that’s often chaotic.

With both utility and tax functionality built into one cohesive platform, you gain consistency, control, and confidence.

Utility Module Benefits

Simplified process for entering utility invoices and generating payments

Enhanced accuracy in utility expense recognition and coding

Prevention of utility payments on closed lots or disconnected lines

Reporting that captures historical utility data for analysis and audits

Tax Module Benefits

Simplified process for entering tax invoices and generating payments

Enhanced accuracy in tax expense recognition and reporting

Automated handling of accruals and amortizations based on region

Tax control tools and historical reporting by lot and community

See MASYC’s Tax and Utility Workbench in Action

Are your Accounts Payable teams spending too much time coding invoices? Are you losing visibility into utility and tax spending across your jobs?

Request a demo today and discover how the Utility and Tax Billing Workbench can streamline your operations, saving time, reducing errors, and providing your team with the clarity they need to work smarter.