MASYC Cash Flow Solution: Bringing Clarity to Project Forecasting

Why cash flow projections should be brought into JD Edwards

Managing projects over many years requires both accurate records of the past and a reliable view of the future. Too often, organizations have one without the other. Actual costs are captured in JD Edwards, but organizations rely on disconnected spreadsheets for forecasting and consequently they face recurring inefficiencies, misaligned projections, and limited visibility. By embedding cash flow forecasting directly into JD Edwards, MASYC’s Cash Flow Solution brings both actuals and projections under one roof.

For executives, this means stronger strategic planning and fewer financial surprises. For finance teams, it means efficiency, accuracy, and confidence in calculating capitalized interest. For project managers, it provides a clearer understanding of how today’s costs influence tomorrow’s commitments.

The future of project cash flow management lies not in spreadsheets, but in integrated ERP solutions that combine the past, present, and future in one system of record. MASYC’s Cash Flow Solution makes that future a reality and can help your organization put the future of project cash flows where it belongs — inside your ERP.

The Business Problem: Gaps in cash flow projection in Standard JD Edwards

JD Edwards EnterpriseOne provides robust job cost accounting and financial reporting, but it does not natively project costs into the future. That means cash flow forecasts often live outside the JD Edwards ERP in spreadsheets or siloed tools. These workarounds create inefficiencies, weaken audit trails, and increase the risk of error.

Key limitations include:

No mechanism to project costs by quarter or fiscal period over a project lifecycle.

Limited visibility into prior period actuals compared to future projections.

Manual and offline methods are often required to calculate capitalized interest.

Difficulty spreading costs evenly or dynamically across fiscal periods or quarters.

No direct linkage between forecasts and job-level or account-level details in the ERP.

For organizations managing long-term, capital-intensive projects, these limitations mean that cash flow forecasts and capitalized interest calculations end up offline (outside of JD Edwards EnterpriseOne) in disconnected tools or third-party applications. Finance teams build complex spreadsheets, attempt to model cash requirements manually, and then struggle to reconcile those numbers with JD Edwards data. This inefficient approach consumes resources, delays reporting, and risks introducing errors into financial planning.

MASYC’s Approach to Cash Flow Projections using JDE

MASYC’s Cash Flow Forecasting Solution for JD Edwards EnterpriseOne was designed to fill the gaps, we address this problem by introducing a custom ledger in EnterpriseOne built on Estimated Cost-to-Complete (ECC). By combining actual costs-to-date with projected final costs, it creates a forward-looking view of project cash flows. This allows organizations to forecast cash flows with confidence and calculate capitalized interest accurately thus giving organizations visibility into financial commitments years into the future.

The MASYC Cash Flow Solution was built to extend JD Edwards functionality without introducing third-party software or heavy customization. The following principles guided its design:

JD Edwards Native

All functionality remains inside JD Edwards using configurable components, ensuring upgrade safety.

Ground Forecasts in Estimated Cost to Complete (ECC)

Projections are based on Estimated Cost-to-Complete (Projected Final minus Actuals-to-Date), ensuring forecasts are tied directly to real project data such as Budgets and Commitments.

Balance flexibility with control

Costs can be spread evenly or adjusted dynamically across future quarters (at either the job level or account level) while keeping everything integrated with JD Edwards ledgers.

How the Cash Flow Projection Solution Works

The solution introduces a custom Cash Flow (CF) ledger that functions alongside existing ledgers, Budgets (JA), Actuals (AA), and Projected Final (HA). Forecasting can take place at both the job level and the account level, depending on the level of detail required.

Job-Level Forecasting

Provides a summary view of projected costs. Users can spread amounts evenly across periods or make targeted adjustments. Prior quarters’ actuals display side-by-side with upcoming projections for context/comparison.

Account-Level Forecasting

Offers a more detailed drilldown into cost codes and accounts, ideal for finance teams who need precision in how costs are projected.

Fiscal Period Controls

Administrators can set fiscal years, ledgers, and periods. Quarter-end processes allow forecasts to roll forward automatically, with the option to reopen periods if adjustments are necessary.

Projection Templates

For advanced planning, templates can be created to distribute costs by percentage across periods or to model different spend patterns, such as conservative versus aggressive outlooks.

By combining these elements, the Cash Flow Solution ensures that forecasts are realistic, flexible, and always tied back to the project records and source data in JD Edwards.

Benefits of the MASYC Cash Flow Solution

Organizations adopting the solution gain tangible benefits and improvements in several areas:

Capitalized Interest Accuracy

Forecasts grounded in Estimated Cost-to-Complete (ECC) provide the correct basis for interest calculations, reducing manual modeling.

Long-Term Visibility

Forecasts extend up to 20 years by quarter, giving executives confidence in future cash needs.

Efficiency and Time Savings

Automated quarter-end processes and spreading options reduce reliance on offline spreadsheets.

Scenario Planning

Unlimited templates make it possible to test multiple projection outlooks and compare results.

Audit Readiness

By keeping all forecasts within JD Edwards, organizations gain a complete, traceable history of assumptions and projections.

The MASYC Cash Flow Forecasting Solution’s Applicability Across Industries

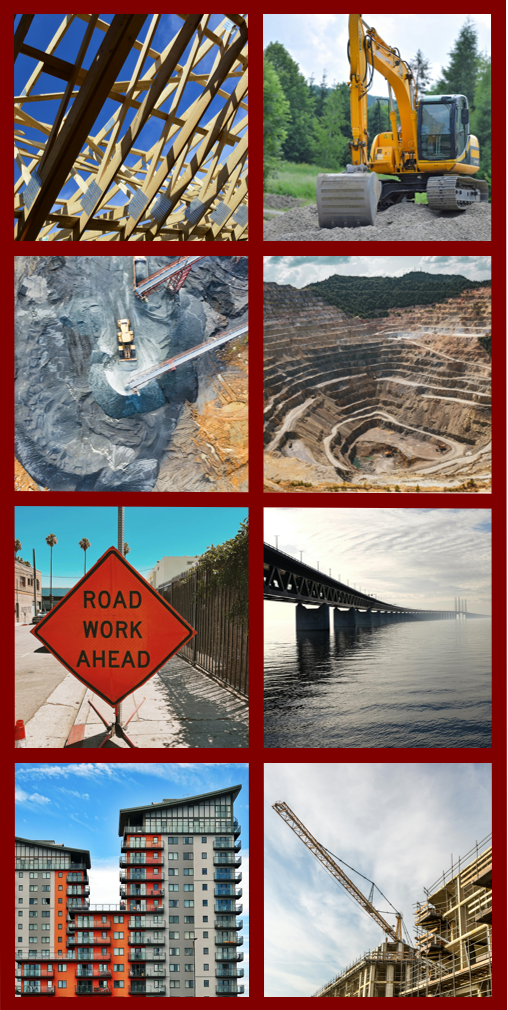

While the solution was originally designed with homebuilding and land development in mind, the framework is broad enough to support any industry that must manage capital-intensive, multi-year projects, including:

Homebuilding & Land Development

Projecting costs for land improvements and infrastructure through master planned community and subdivision buildouts.

Mining & Resource Extraction

Tracking exploration, permitting, and site development costs for capitalized interest purposes.

Construction & Infrastructure

Managing long-term projects requiring precise cash flow planning.

Commercial Real Estate

Forecasting costs from acquisition and/or improvements through tenant-ready delivery.

The common factor across all these industries is the need to calculate capitalized interest accurately and to manage forward-looking costs tied to major assets.

How the Cash Flow Solution Fits into MASYC’s JD Edwards Strategy

One of the key advantages of MASYC’s approach is that it works seamlessly with MASYC’s other JD Edwards native solutions developed in-house, including our Pre-Acquisition, Land Management, and Budget Management solution frameworks.

In a typical lifecycle:

Pre-Acquisition Solution – tracks associated attributes and costs for prospective land and transfers approved land deal costs-to-date into capitalized jobs via Orchestration.

Land Management Solution – tracks large or small land development projects in phases/sub-phases with releases and projections as well as user defined category codes.

Budget Management Solution – governs approval routing for budgets on capitalized jobs while allowing for flexibility in managing budgets from start to finish.

Cash Flow Solution – allows teams to control and project costs of a land asset (based on Estimated Cost-to-Complete) as well as give visibility of the costs for that asset well into the future allowing finance to accurately and efficiently calculate capitalized interest.

This integrated approach means that from the earliest planning to the final close-out, all budgetary actions are managed inside JD Edwards – with full visibility, approvals, and control.

Why your JD Edwards instance needs MASYC’S Cash Flow Forecasting Solution

Every capital project tells two stories: what has already been spent, and what remains ahead. In industries such as land development, construction, homebuilding, commercial real estate and mining, both stories are equally important.

Managing large-scale projects requires more than budgeting and tracking costs as they occur. Projects carry significant financial commitments over many years, and organizations must be able to anticipate not only the immediate spend but also the projected costs and their impact on financial reporting. This is especially true for projects where capitalized interest must be calculated. With no clear view of projected costs, finance teams cannot calculate capitalized interest correctly, executives cannot anticipate funding needs, and project managers cannot align decisions with long-term financial outcomes. Now your team can keep track of all phases of your projects in JD Edwards: past, present and future.

Without reliable forecasts and visibility into how costs flow over time, finance teams struggle to calculate interest correctly, project cash requirements, and provide timely feedback to leadership. Make your team and your JD Edwards EnterpriseOne setup more efficient with MASYC’s Cash Flow Forecasting Solution.